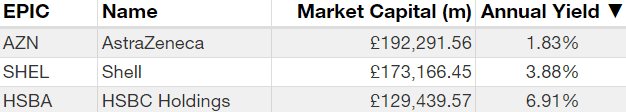

I’m considering the passive income I could make from the top three dividend stocks on the FTSE 100 by market cap: AstraZeneca, Shell and HSBC.

AstraZeneca is the largest company on the list, with a market cap of £192bn. However, it pays the smallest yield of 1.83%. I’d need to buy a lot of the shares to earn any dividends worth a mention. But it’s not an income share, is it? With a share price up 105% in the past five years (equating to annualised returns of 15.5% a year) it’s firmly in the growth category. On top of the dividends, it adds up to a very meaty total return of 17.33% per year.

Naturally, I can’t assume that kind of return will continue but it’s impressive, nonetheless.

Should you invest £1,000 in Ashtead Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ashtead Group Plc made the list?

Next on the list, Shell has a £173bn market cap and a more attractive yield of 3.88%. What has it done over the past five years, though? Nothing near the spectacular performance of AstraZeneca, that’s for sure. Up only 8.6%, its annualised returns are a rather sad 1.66%. Even with the yield, combined returns are barely above 5.5% — less than the FTSE 100 average.

Which brings us to HSBC. An impressive dividend payer with a 6.91% yield and a solid market cap of £129bn. But the price has barely moved in five years, up only 6.15%, providing annualised returns of only 1.2%. Still, when including dividends, it adds up to 7.35%.

Combined, they provide an overall average return of 10.6%. I could expect a £10k investment to grow to about £26,000 in 10 years. That’s slightly above average but not spectacular – and it’s based on the assumption that the dividends and returns would remain consistent.

A future dividend hero?

What I really want when looking for passive income is evidence of reliable payments that are likely to continue increasing annually. One stock that caught my attention lately is Ashtead Group (LSE: AHT).

The yield is small but shareholders have enjoyed 17 consecutive years of dividend growth, with a growth rate of 33.63% over the past decade. What’s more, the share price is up 182% in the past five years, delivering a huge 22.9% in annualised returns. If the price and dividends continued to grow at that rate, a £10,000 investment could reach £158,000 in only 10 years!

Of course, that’s an unrealistic expectation but it points to one truth: Ashtead’s recent performance has been exceptional.

The UK-born construction rental group has expanded aggressively into the US, its largest market. But it’s come at a cost. It now carries £6.7bn in debt, outweighing its £5.4bn of equity. Only during Covid was its debt-to-equity ratio higher. It’s taking a risk if it continues to spend at such a rate.

The growth also means its price-to-earnings (P/E) ratio of 18.8 is now higher than the industry average. That leaves little room for further price growth. But earnings and revenue remain strong and future return on equity (ROE) is forecast to be 23.7% in three years. That’s almost double the industry average.

So yes, the recent price growth may be unsustainable. But the company’s commitment to increasing dividends makes me want to buy the shares as soon as I have some free capital.